S corporations: What they are and 5 benefits of becoming one

So, you’ve started a small business, and you want to incorporate for business or legal reasons. Before you do, you should know about a business structure that can actually give you significant benefits: S corporations.

By incorporating as an S corporation (or S corp), you can avoid the double taxation that's usually associated with incorporating your business. An S corp may reduce how exposed your profits are to self-employment taxes, helping you reduce your taxes for the year. This could make up for the additional costs associated with incorporating and have some money left over to invest in other parts of your business.

An S corporation can offer real tax advantages for some small business owners—but it also comes with stricter rules, higher compliance requirements, and increased audit scrutiny. In this guide, we’ll walk through the potential benefits of an S corp, explain how owner pay and taxes actually work, and highlight the situations where an S corp makes sense—and where it doesn’t. This article is intended for educational purposes and reflects current federal tax rules, but individual results vary based on income, state law, and how the business operates.

We’ll be covering the top benefits as well as the advantages and disadvantages of S corps over other business types:

- Tax Advantages

- Health Insurance Tax Savings

- Employee Expense Deduction Under an Accountable Plan

- Retirement Planning

- Advantages and Disadvantages of S Corps

What is an S Corporation?

Before we get into the thick of it, let's go over what an S corporation actually is.

An S corporation is a type of small business corporation. A corporation is a legal entity that is separate from its owners, which means its owners and shareholders aren't held responsible for the finances (including debt) or actions of the business.

Qualifying to become an S Corporation

Only certain entities can elect to become an S corporation, and they must maintain that status throughout the entire tax year to qualify for tax benefits. Here's what you need to qualify as an S corp:

- The business entity must be either a U.S. formed LLC or regular C corporation

- Cannot have more than 100 shareholders

- Must only have one class of stock

- All shareholders must be U.S. resident individuals

- U.S. citizens or legal residents of the U.S.

- Certain trusts and estates may qualify; check with your tax advisor

Benefits of S Corporations

While there are obvious benefits to incorporating any type of business, S corps offer unique and pretty useful benefits that other structures do not. Here are four of the top benefits of becoming an S corp:

1. Tax advantages

Let's talk S corporation taxation. The main benefit of incorporating as an S corporation over being self-employed is the tax savings on self-employment taxes (Social Security and Medicare). For each dollar of profit, it could mean as much as 14.13% in savings when it's time to pay taxes.

An S corp must pay a reasonable salary to any shareholder/employee. While a reasonable salary will reduce profits, any profits that remain after deducting a reasonable salary and other tax deductions are no longer subject to self-employment tax.

After determining what your reasonable salary should be, you can start with regular payroll. Not to brag, but Wave's small business payroll software is a breeze because it helps you pay yourself and your team and generates important reports and documents for you, leaving you prepared for tax season. Plus, it teaches you as you go, so no accounting experience is necessary.

A note on “tax savings” and IRS scrutiny

S corporations can reduce self-employment tax exposure on distributions, but savings are not automatic and depend on:

- Business profitability

- Reasonable compensation

- Payroll and compliance costs

- Federal and state tax rules

Paying yourself an unreasonably low salary is one of the most common S corp audit triggers. A tax professional can help model whether an S corp election actually makes sense for your situation.

“We were using a million different platforms to do what Wave can do all in one. It just worked. It was so painless. It’s helping me run my business and not worry about payroll." - Will Perkins, Continue

2. Health Insurance Tax Savings

If you own more than 2% of an S corporation and are also an employee, your S corp can generally pay for your health insurance premiums.

Here’s how it typically works:

- The S corporation pays or reimburses the premiums.

- The cost is included in your W-2 wages for income tax purposes (but not subject to Social Security or Medicare tax in most cases).

- You may be able to claim the self-employed health insurance deduction on your personal return.

However, your ability to deduct these premiums can be limited if you or your spouse are eligible to participate in an employer-sponsored health plan, even if you don’t actually enroll.

Caution: Health insurance deductions for S corp owners are highly technical, and ACA marketplace credits can complicate eligibility. Improper reporting is a common audit issue. Always coordinate W-2 reporting and personal deductions with a tax professional.

Let’s go back to our previous example with Emily. To recap: Emily earns $100,000 through her S corporation and pays a reasonable salary of $40,000. If we assume that $10,000 was paid for health insurance premiums, the amount of salary subject to Social Security and Medicare is reduced by the premiums to $30,000. Since we don’t need to pay taxes on the health insurance premium, this amounts to payroll tax savings of $1,530 (15.3% of $10,000).

3. Employee Expense Deduction Under an Accountable Plan

Under current tax laws, employees can no longer deduct out-of-pocket (when you use your own money to pay for something) business expenses on their personal returns. As a result, the only option for employees to not be out-of-pocket is to get reimbursed by the corporation.

For an S corporation with shareholder employees, out-of-pocket business expenses can be paid by the employee and reimbursed by the S corp. These can include home office rent, car mileage or transportation costs, cell phone and Internet plans, and more.

To do this, the S corporation must set up an Accountable Plan, which is used for reimbursing workers for business expenses that are not counted as income. An Accountable Plan requires expenses to be substantiated for business purposes, where excess payments should be returned within a reasonable time period.

Remember that the personal use portion of these expenses (i.e. personal mileage, personal cell phone calls and personal use of the Internet) must not be reimbursed by the S corporation, and submitting incorrect expenses could be a red flag with the IRS. When creating an Accountable Plan, it can be helpful to keep a shortlist of popular deductions and expenses for you and your team.

4. Retirement Planning

An S corporation structure can expand retirement planning options, but contribution limits change by tax year and depend on how owner compensation is set up.

For Tax Year 2025 (returns filed in 2026), key federal limits include:

- 401(k) elective deferrals: Up to $23,500

- Catch-up contribution (age 50+): Up to $7,500

- Enhanced catch-up (ages 60–63, under SECURE 2.0): Up to $11,250

- Total defined contribution plan limit (employee + employer): Up to $70,000 (or $77,500–$81,250 with catch-ups, depending on age)

Because S corp retirement contributions are often tied to W-2 wages, paying yourself an unreasonably low salary can also limit how much you’re allowed to contribute.

If you decide to contribute to a retirement plan, keep in mind that the time of year you contribute can affect tax filing. Make sure to contribute before your tax filing deadline to make the most of your contributions.

Important: Retirement limits and rules change regularly. Always confirm current-year limits and coordinate payroll, retirement contributions, and tax filings with a qualified tax professional.

5. Advantages and Disadvantages of S Corps Over Other Business Types

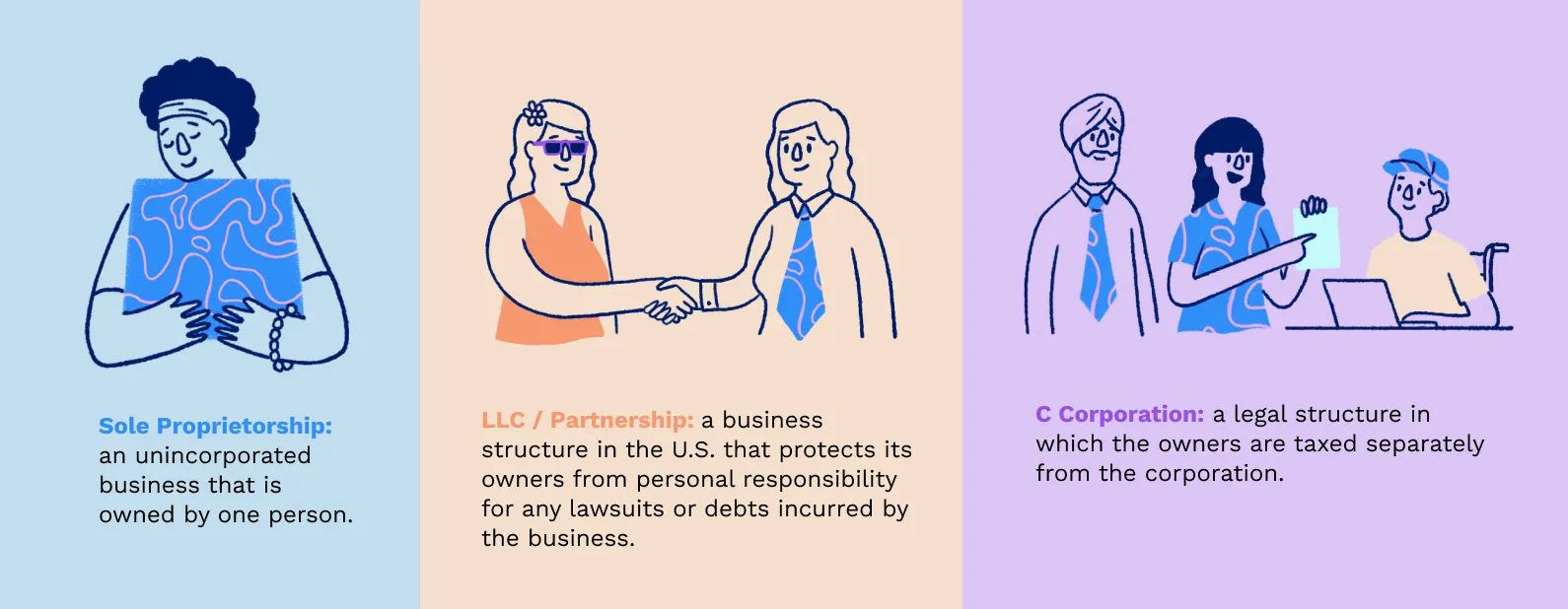

Before we start comparing the benefits to incorporating as an S corporation over other forms of business, let's go over some definitions.

A sole proprietorship is an unincorporated business that is owned by one person; the owner is not separate from the business. An LLC/partnership is a business structure in the U.S. that protects its owners from personal responsibility for any lawsuits or debts incurred by the business. And, finally, a C corporation is a legal structure in which the owners are taxed separately from the corporation.

S corporation advantages over sole proprietorships

- An S corp will help protect your personal assets

- S corps have an unlimited life, which means they exist after the passing of the owner

- It’s easier to transfer ownership of the business as an S corp

- An S corp can help you save on self-employment taxes

S corporation advantages over LLC/partnerships

- LLC members/partners cannot be employees

- S corp profits are not subject to self-employment taxes

- S corps don't expire, while LLCs can

- You only need one person is order to form an S corporation

- S corps have more financing options, so there is more potential to scale

S corporation advantages over C corporation

- Flow-through taxation: S corps avoid corporate income tax and most federal taxes on earnings

- S corps are easier to start and sustain than C corporations

It's also important to consider the disadvantages of S corporations to see if becoming one is right for you.

Sole proprietorship advantages over S corporations

- Pass-Through Taxation: sole proprietors pay federal income tax and self-employment tax at each owner’s personal income tax rate, rather than the business's

- There's no paperwork needed to become a sole proprietorship

LLC/partnership advantages over S corporations

- LLCs offer more flexibility than S corps, especially when it comes to IRS and government regulations and allocating their profits and losses

- LLCs are generally easier and cheaper to establish

- An S corp must have specifically appointed members, like board directors, and regular board meetings

C corporation advantages over S corporations

- There are more restrictions on S corps, so C corporations sometimes have more room to grow. However, it is easy to switch from an S corp to a C corporation.

Is an S corp right for your business?

An S corporation can be beneficial in the right circumstances, but it’s not a one-size-fits-all solution. You may want to explore an S corp election if most of the following are true:

You may be a good candidate if:

- Your business generates consistent net profits (often after expenses) beyond what you’d reasonably pay yourself as a salary

- You actively work in the business and can justify a reasonable W-2 wage based on industry norms

- You’re prepared to run payroll, file quarterly payroll reports, and issue yourself a W-2

- You want access to expanded retirement planning tied to wages

- You understand there are ongoing administrative and tax-filing costs

An S corp may not be a good fit if:

- Profits are low, inconsistent, or unpredictable

- You’re unwilling or unable to pay yourself a defensible salary

- You don’t want the added complexity of payroll, separate business tax returns, and compliance

- You operate in a state with high S corp minimum taxes or fees that offset potential savings

Bottom line: An S corp election should be modeled with real numbers, not rules of thumb. What saves money for one business can cost another more in taxes and compliance.

Don’t ignore state taxes and fees

Federal tax savings don’t tell the whole story. Many states impose additional rules, taxes, or fees on S corporations, such as:

- Minimum franchise taxes or annual fees

- Entity-level income or gross receipts taxes

- Different treatment of S corp distributions

- Payroll and unemployment insurance requirements for owner-employees

These state-level costs can significantly reduce—or eliminate—the federal tax advantage of an S corp.

Tip: Always evaluate S corp savings after factoring in your state’s rules. This is a common blind spot that leads to disappointing results.

Common mistakes that cause penalties or audits

S corporations are closely scrutinized by tax authorities. Some of the most common problems include:

- Unreasonably low owner salaries to minimize payroll taxes

- Paying personal expenses from the business without proper documentation

- Missing or late payroll tax filings and deposits

- Incorrect health insurance reporting for >2% shareholders

- Treating distributions as “tax-free” without tracking stock and debt basis

Any of these issues can result in back taxes, penalties, interest, and reclassification of income.

Moving forward with business incorporation and the election

If you have decided to structure your business as an S corporation, and if you are currently operating as a sole proprietor, it is best to seek a professional to assist with the formation of your LLC or corporation. If your business has other partners, shareholders, or members you will need to get them to agree to your decision.

After registering your business, be that an LLC or corporation, make sure to file the S corp election with the IRS within two months and 15 days from the incorporation or formation date. If you have passed that date, you may still qualify for late election approval.

As you look at incorporation and an S corp election, you should weigh the tax benefits and potential administrative costs of the different structures. We see a lot of business owners not knowing their options and the associated benefits, so we want to make sure you are informed.

Wave Advisors can help with your incorporation journey. The Wave team can support your S corporation planning by helping you understand if incorporating makes the most sense for your business from a tax perspective. They can also walk you through processes and forms, like election Form 2553, to help you prepare the strongest possible application, and file easily with the IRS.

Once an S corp election is approved by the IRS, business owners can start using Wave Payroll as an ongoing feature to properly manage their finances and truly reap all of the benefits that come along with being an S corporation.

Educational disclosure: This article provides general information based on current U.S. federal tax rules. Tax outcomes vary based on individual circumstances, state law, and business operations. Consult a qualified tax professional before making an S corporation election or changing how you pay yourself.

(and create unique links with checkouts)

*While subscribed to Wave’s Pro Plan, get 2.9% + $0 (Visa, Mastercard, Discover) and 3.4% + $0 (Amex) per transaction for the first 10 transactions of each month of your subscription, then 2.9% + $0.60 (Visa, Mastercard, Discover) and 3.4% + $0.60 (Amex) per transaction. Discover processing is only available to US customers. See full terms and conditions for the US and Canada. See Wave’s Terms of Service for more information.

Our in-house tax pros are here to guide you through your S-Corp declaration

The information and tips shared on this blog are meant to be used as learning and personal development tools as you launch, run and grow your business. While a good place to start, these articles should not take the place of personalized advice from professionals. As our lawyers would say: “All content on Wave’s blog is intended for informational purposes only. It should not be considered legal or financial advice.” Additionally, Wave is the legal copyright holder of all materials on the blog, and others cannot re-use or publish it without our written consent.